AI Enhanced Market Research Vector Stores & Workflows

Modern market analysis is being transformed by the integration of AI with the traditional TAM/SAM/SOM framework, enabling both top-down and bottom-up approaches to become more sophisticated and accurate. Through the use of vector databases and multi-agent AI systems, companies can now analyze historical market patterns across different sectors, identifying similar growth trajectories and market share development patterns from category creators like ZocDoc to market disruptors like Red Bull. The implementation of AI workflows, connecting data collection, analysis, visualization, and integration agents, allows for real-time market sizing updates and dynamic visualizations through tools like LucidChart and Miro. While AI significantly enhances the speed and accuracy of market sizing, human oversight remains crucial for strategic interpretation and decision-making, creating a powerful combination of artificial and human intelligence in market analysis.

Edward Boyle

12/30/20244 min read

Integrating AI into Market Research: TAM/SAM/SOM Systems

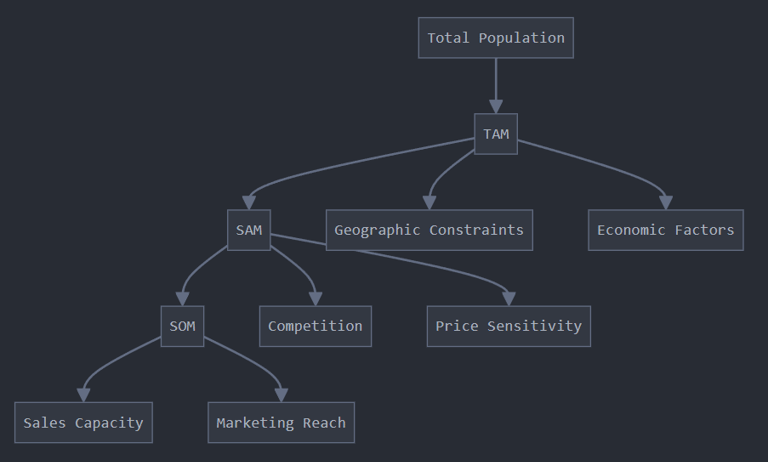

In today's rapidly evolving business landscape, market size analysis remains a cornerstone of strategic planning. The traditional TAM/SAM/SOM framework (Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market) has long guided businesses in understanding their market potential. However, the emergence of generative AI and multi-agent systems is revolutionizing how we approach this crucial analysis. This article explores how AI can enhance traditional market research methods while increasing both speed and accuracy.

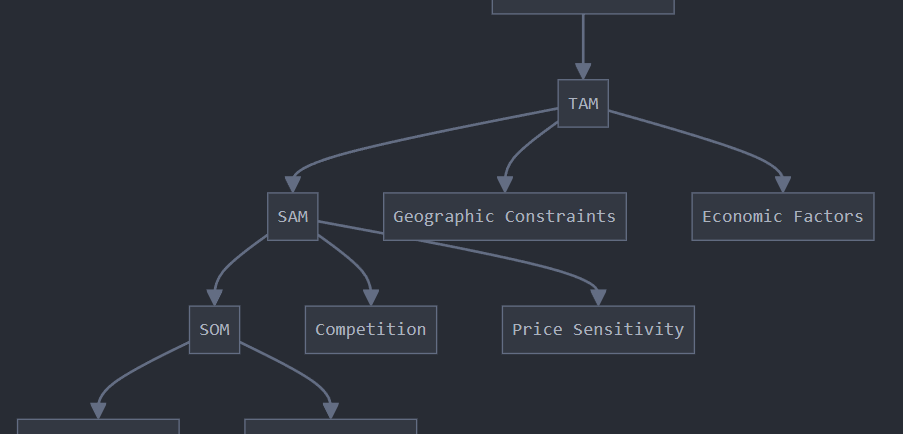

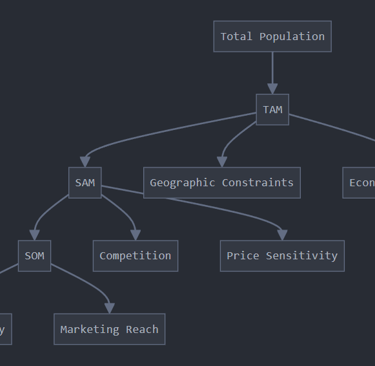

Currently, most companies do a decent job of estimating TAM using a series of industry reports that all gravitate towards similar growth rates. However, the SAM subset is often a wild guess based on some simple regional or demographic split. Similarly, the SOM subset is another wild guess in the 3% to 10% share range, maybe using some similar company that was able to get that much. Using Gen AI and vector stores, we can get much more systematic about which factors are reducing the SAM and SOM at each stage.

The Evolution of Top-Down Market Research: Data-Driven Precision

Traditional top-down market analysis has been revolutionized by the integration of AI with historical market databases and vector stores. This combination enables analysts to make more nuanced predictions based on analogous market developments across different sectors and time periods.

Database Integration for Enhanced Analysis

Modern AI systems can simultaneously access and analyze:

Industry-specific market research databases (e.g., Frost & Sullivan, IBISWorld)

Historical company performance data

Patent databases for innovation tracking

Regulatory filing databases

Social media sentiment data

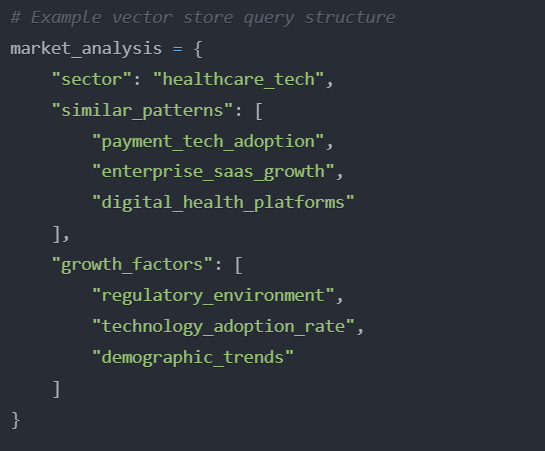

By vectorizing this data, AI can identify patterns in market evolution across seemingly different sectors. For example, when analyzing a new healthcare technology market, the AI might identify similarities with:

The evolution of mobile payment adoption in fintech

Enterprise SaaS penetration rates in different verticals

Consumer adoption curves for digital health platforms

Pattern Recognition in Market Share Development

AI systems can now analyze historical patterns of market share development across different company types:

Category Creators (High Share Potential):

ZocDoc's development in healthcare booking (achieved 40% market share in key metros)

Airbnb's creation of the mainstream home-sharing market (>19% of lodging in major markets)

Uber's dominance in ride-hailing (>65% in many markets)

Large Market Disruptors (Moderate Share):

Red Bull's growth in the massive beverage market (0.5% of total beverages, but 46% of energy drinks)

Beyond Meat's penetration of the protein market (1.4% of total protein, but 35% of plant-based)

The AI can adjust TAM projections based on these patterns, considering:

Market maturity stage

Regulatory environment

Technology adoption curves

Competition dynamics

Vector Store Implementation

Modern implementations utilize vector stores to create sophisticated market analysis systems that can quickly retrieve and analyze relevant market patterns and growth trajectories. These systems connect to visualization tools like LucidChart for dynamic market mapping.

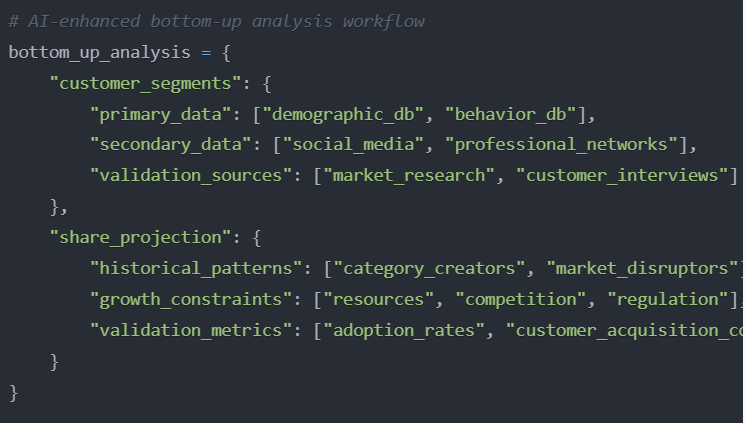

Bottom-Up Analysis: Granular Insights Through AI

The bottom-up approach benefits significantly from AI's ability to process granular data points and identify subtle patterns in customer behavior and market development.

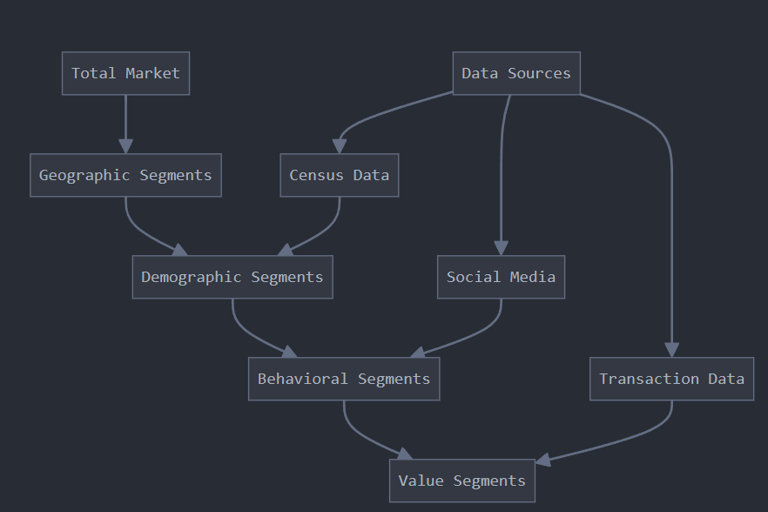

Customer Segmentation Enhancement

AI systems can now integrate multiple data sources for precise customer segmentation.

Demographic Data:

Census databases

Consumer behavior databases

Social media activity patterns

Professional network data

Purchasing Power Analysis:

Regional economic indicators

Industry-specific spending patterns

Technology adoption rates

Disposable income trends

Let's visualize this segmentation approach: Customer Segmentation Flow

Market Share Projection Using Historical Patterns

AI can analyze successful companies' growth trajectories to project realistic market share development:

High-Growth Scenarios:

Analysis of unicorn growth trajectories

Market creation patterns

Network effect acceleration curves

Moderate Growth Patterns:

Traditional market entry curves

Competitive response patterns

Resource constraint impacts

Market Expansion Analysis

AI excels at identifying and analyzing expansion opportunities through pattern recognition and predictive analytics. A multi-agent system can simultaneously evaluate:

Geographic expansion potential

Product line extensions

Market segment opportunities

Pricing tier possibilities

AI agents can be configured to continuously monitor:

Market entry barriers

Regional growth rates

Cultural adaptation requirements

Competitive dynamics

By connecting these analyses to visualization tools like Miro, businesses can create dynamic expansion roadmaps that update automatically as market conditions change.

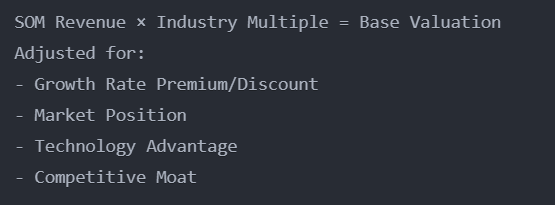

Valuation Integration

The final step in market sizing often involves translating market share projections into company valuations. AI can enhance this process by:

Automatically updating revenue multiples based on market conditions

Generating scenario-based valuations

Integrating market sentiment analysis

Creating dynamic valuation models

Consider this SOM valuation sample calculation flow:

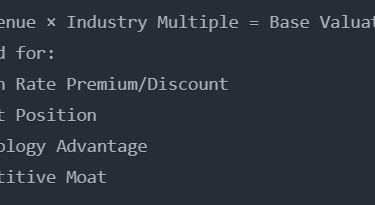

Building an Integrated AI Workflow

To implement these AI-enhanced processes, organizations can create a comprehensive multi-agent workflow using platforms like Microsoft Copilot Studio or custom GPTs. Here's a recommended architecture:

Data Collection Agents:

Monitor market research databases

Scrape relevant news and updates

Process competitor information

Analysis Agents:

Normalize and clean data

Perform statistical analysis

Generate forecasts

Visualization Agents:

Create standardized charts

Generate presentation-ready graphics

Update dashboards

Integration Agents:

Connect with external tools

Maintain database consistency

Generate automated reports

Looking Forward

The integration of AI into market sizing analysis represents a significant leap forward in both accuracy and efficiency. By combining traditional methodologies with AI-powered tools, organizations can:

Process more data sources

Generate more accurate projections

Identify opportunities faster

Create more dynamic visualizations

Update analyses in real-time

The future of market sizing will likely see even greater integration of AI tools, with increasingly sophisticated multi-agent systems handling complex analyses automatically. Organizations that embrace these technologies today will be better positioned to make data-driven decisions tomorrow.

Remember that while AI significantly enhances the market-sizing process, human oversight remains crucial for strategic interpretation and decision-making. The most successful implementations will balance AI capabilities with human expertise to create comprehensive, accurate, and actionable market analyses.

This integrated approach to market sizing, combining AI-powered analysis with traditional methodologies, represents the future of strategic market planning. By leveraging these tools effectively, businesses can make more informed decisions about market entry, expansion, and resource allocation.